Harrison Financial Services is committed to providing ongoing education and insights related to holistic wealth management. Members of the Harrison Financial Services Investment Committee provide Weekly updates to ensure our clients, colleagues and industry partners are well informed on the latest industry trends and market movements.

The opinions expressed are those of Harrison Financial Services as of the date stated on each communication and are subject to change. The investment professionals at Harrison Financial Services provide views and commentary on the current marketplace. This information is designed as general commentary regarding our views on the relative attractiveness of different asset classes and asset allocation strategies. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security.

Keep in mind that this viewpoint can and will change as valuations and economic variables evolve. These views are made in the context of a well-diversified portfolio, not in isolation, and are not a recommendation for individual investors. Decisions about investments should always be made on an individual basis or in consultation with a Financial Advisor, based on an individual’s preferred risk levels and long-term goals.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

A (Humble) HFS Victory Lap

December 20, 2024

Investing isn’t easy. It’s incredibly competitive and attracts many intelligent minds due to the stakes at hand. It is impacted by many variables, and most of the important ones that move the market are unknown and under constant change. Read the full article here.

Artificial Intelligence is Accelerating the Digital Economy

December 12, 2024

At HFS, we continue to believe that artificial intelligence (AI) will prove to be one of the greatest technological innovations in modern history. At some point, we think that it will be inconceivable for future generations to believe that humans spent time working on computers instead of computers working for humans. Read the full article here.

Rethinking Risk Management

December 5, 2024

Investors go to great lengths to manage risk. We diversify, allocate to bonds, consider valuations, use hedging strategies, among other tactics. This is usually all done in the name of limiting volatility since few enjoy watching their life savings gyrate wildly up and down. Read the full article here.

Consensus Loves Small Caps, but Why?

November 26, 2024

One of Wall Street’s dirty little secrets is that much of its forecasts are based upon “mean reversion”. In other words, whatever hasn’t been working will reverse, or vice versa. We’ve heard this for years regarding international stocks versus US, value versus growth, corporate profit margins peaking, etc. Read the full article here.

Learning from Past Technological Disruptions

November 21, 2024

At HFS, we believe anticipating the future is one of the most important skills for investors. You could be a “valuation expert” with the most sophisticated financial models, but it won’t help without solid inputs and assumptions. Read the full article here.

It’s Time to Modernize Investments

November 14, 2024

The world is an evolving place. Change is constant, and so we must adapt or risk falling behind. It’s hard to think of a profession that hasn’t undergone a meaningful shift in approach and philosophy over recent decades. Read the full article here.

If They Build It, We Will Come

November 6, 2024

HFS believes that artificial intelligence (AI) will become one of the greatest technological innovations in modern history. It’s not just us who believes that – there are a lot of brilliant technology CEOs that are also making big bets that this happens. Read the full article here.

Structured Products – Buyer Beware

October 30, 2024

There’s no such thing as a free lunch. This is what comes to mind when clients ask us about structured products. These are highly-customized and complex securities that are often sold with the promise of limited downside risk yet attractive upside –like a hybrid between a stock and bond. They are called “structured” because they reshape the original investment’s risk/return profile. Read the full article here.

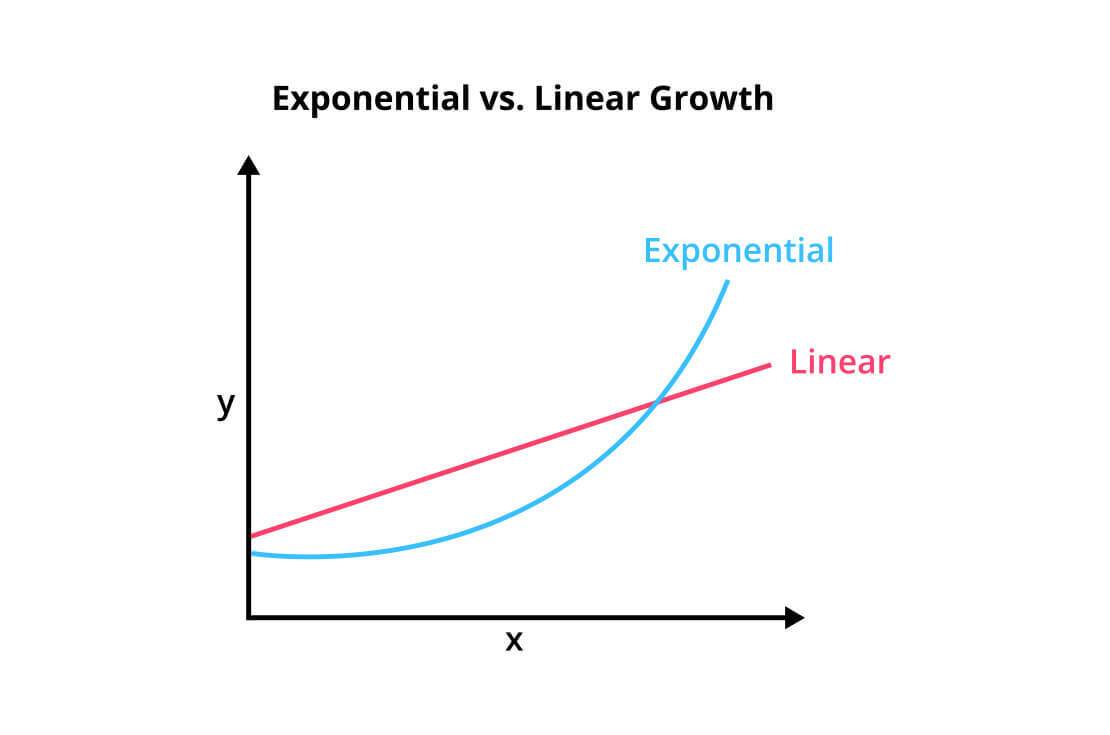

Stop Thinking Linearly in an Exponential World

October 24, 2024

We’re living in a time of exponential change. It started decades ago with the introduction of the personal computer and the internet, and it’s continuing with newer technologies like cloud computing, electric cars, and artificial intelligence. Read the full article here.

AI Factories Are Going Nuclear

October 17, 2024

The nuclear power industry is seeing a revival due to power-hungry artificial intelligence (AI) data centers. Google recently announced that it will fund the construction of seven small nuclear-power reactors to be built by a startup called Kairos Power. Read the full article here.

The Rules are Different in the Digital World

October 10, 2024

“Unprofitable tech.” It’s a phrase we’ve heard a lot over the past 15 years during the rise of the digital economy. Oftentimes, it is used as a knock against “growth” investing or a sign of a broken or overvalued business model. Read the full article here.

Chinese Stocks Just Had a Week. Can it Last?

October 2, 2024

Last week, Chinese stocks went on a historic run due to new government stimulus measures to jumpstart its ailing economy and real estate market. That government announced multiple interest rate cuts, reduced reserve requirements for banks, lowered mortgage rates on existing homes, providing funding to buy back stocks, and more. Read the full article here.