At HFS, we continue to believe that artificial intelligence (AI) will prove to be one of the greatest technological innovations in modern history. At some point, we think that it will be inconceivable for future generations to believe that humans spent time working on computers instead of computers working for humans. Today, we have a digital economy along with digital currencies. Now, we are adding digital workers, which are better known as AI agents. This idea has meaningful ramifications for existing growth trends, whether that’s e-commerce, digital advertising, software-as-a-service, and cloud computing, to name a few.

Despite having been around for over 20 years, the adoption of these trends remains fairly tempered. For example, e-commerce is estimated to only represent about 22% of US retail sales (Digital Commerce 360). Digital advertising is around 60% of global advertising spend (OnAudience). Cloud computing is shown to only be about 50% penetrated (Gartner). However, AI is becoming a meaningful accelerant towards growing this digital economy.

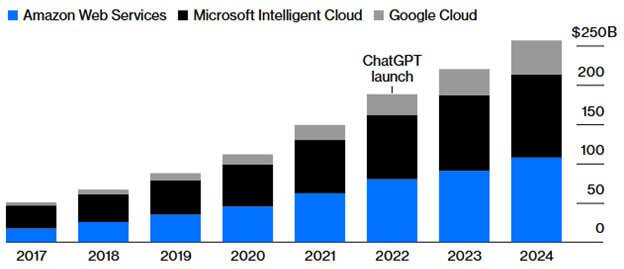

Cloud Sales Top $250 Billion Since ChatGPT

Annual revenues for the three dominant cloud service providers

Source: Company earnings reports via Bloomberg

Note: 2024 includes Q4 estimates.

Let’s consider how AI reinvigorated growth of cloud computing. Back in 2022, spending on this area of technology began to slow meaningfully. Cloud computing wasn’t declining, but it appeared that the days of 30% growth rates had passed as firms cut expenses and headcount. Many investors were pondering whether the cloud computing market was nearing maturity. Then the narrative began to change in 2023 due to AI. Not only was AI expensive and cost prohibitive for smaller firms to buy directly, but it was also hard to find supply. Cloud computing democratized access to AI chips through a subscription agreement and helped reaccelerate industry growth, which is a rare occurrence for a market of this size.

HFS believes we remain in the early innings of the AI revolution. While some will fixate on a handful of beneficiaries, the history of the technology industry shows how such transformations tend to fuel secondary effects. The emergence of the internet in the 1990s helped reinvigorate growth in the personal computer and semiconductor industry. The introduction of the iPhone helped form the “app” economy and fuel digital commerce, which shifted even more ad dollars online. We’re just starting to see the initial impact of AI and what it means for various firms and industries.

We think many occupations will prove to be beneficiaries. Some won’t. It will be fascinating to see how making computers work for us instead of the other way around will change our society. However, understand that the buildout phase of major technology transformations is usually the beginning – not the end.

The opinions expressed are those of Harrison Financial Services as of December 12, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested.