Guide To Legacy Planning

In this guide, we’ll help you understand the key elements of leaving a legacy and discuss strategies to help you better prepare the rising generation to receive the wealth you’ve created and carry on your legacy.

READ MORE

Sharing A Culture of Caring with Clients

At Harrison Financial Services we continually seek ways we can improve our client service model by providing unique services and care that differentiate us from other top-notch advisors and family offices.

READ MORE

Impact of Higher Rates on Asset Prices

As investors and consumers, we deal with a multitude of interest rates during our lives - from fixed deposit rates on our bank savings to mortgage rates, student loans, and those stubbornly high credit card rates.

READ MORE

Digital Asset Policy

Upholding our commitment to providing integrated wealth management and investment planning, Harrison Financial Services is committed to understanding alternative investments and new investment offerings, including digital assets.

READ MORE

Updated 7 Views for 2022

2022 has proven to be full of unexpected events impacting the economy and financial markets. We remain comfortable with our current positioning and offer our updated 7 views for 2022.

READ MORE

How Will Your Business Endure Without You?

Five straightforward business succession planning steps to help your business gain a tactical advantage today — and in the future.

READ MORE

Guide To Charitable Giving

Charitable giving is an important component of your overall financial plan. This guide will help you build a strategy for your charitable donations.

READ MORE

Excess Cash

Do you have excess liquidity available on your balance sheet? Put your cash to work for you. Learn More.

READ MORE

7 Views of 2022

2022 is a year to not become complacent about your investments. Have a plan to invest excess liquidity, make sure investments are rebalanced appropriately, and prudently control costs and tax impacts. Learn More.

READ MORE

2021 Annual Update

2021 was a record year for Harrison Financial Services! Learn More about what makes us unique and why our clients report a “world-class” Net Promotor Score year after year.

READ MORE

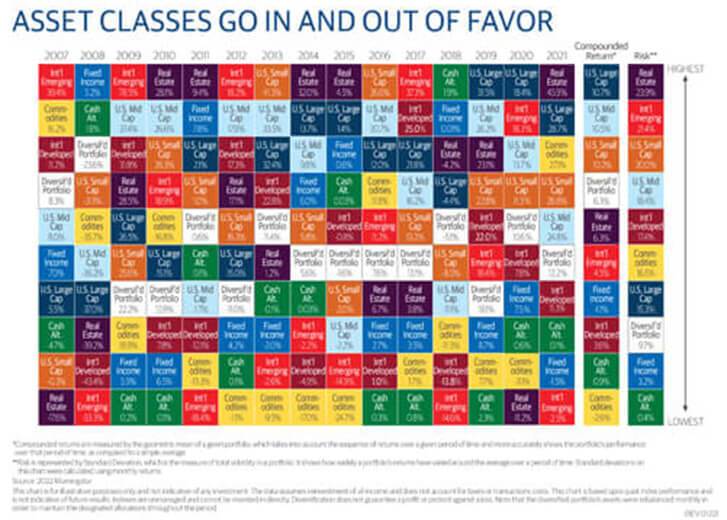

The Quilt

Investors who commonly look at the big picture and invest for the long-term find comfort in reviewing the investment “quilt”, which illustrates the value of a diversified portfolio. Learn More.

READ MORE

Down Markets Matter

Has your tolerance for risk diminished during retirement, yet you rely on a fixed income to maintain your standard of living? Understand how the markets impact your qualified investments and consider complimentary products for your overall portfolio. Learn More.

READ MORE