The world is an evolving place. Change is constant, and so we must adapt or risk falling behind. It’s hard to think of a profession that hasn’t undergone a meaningful shift in approach and philosophy over recent decades. Generally speaking, doctors today are much more knowledgeable and advanced than they were 50 years ago. The same is true for engineers, lawyers, architects, scientists, athletes, musicians, etc. However, it’s difficult to find such progress in the investment profession. Today, many portfolios are still based upon concepts and philosophies that were developed over 50 years ago. Often, these historical patterns no longer exist or hold little predictive value. In fact, our industry is so resistant to change that the phrase “this time is different” is said to be the four most dangerous words in investing. Imagine if your surgeon was this resistant to change.

We believe it’s absolutely different this time. Those that recognize this are prospering. Those resistant to change are falling behind.

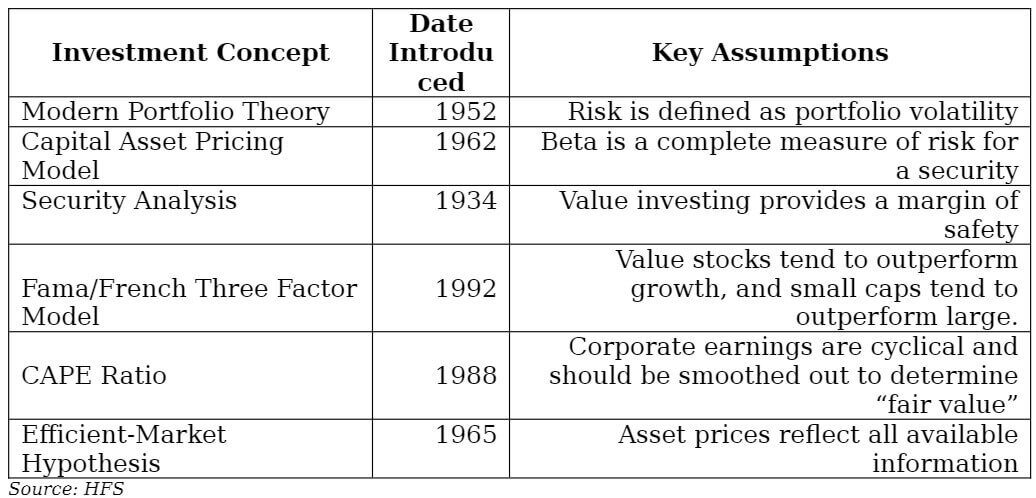

The investment concepts listed in the chart above were considered cutting edge at the time they were introduced. Many authors received Nobel awards for their work. We’re not arguing that all are obsolete. However, technology, capital markets, and business models have meaningfully changed since these concepts were introduced. Here are a few of our observations of what’s different today.

The US stock market is no longer driven by cyclical companies.

In 1957, cyclical sectors (financials, industrials, energy, materials) made up about 75% of the S&P 500. Today it’s only 38%. Meanwhile, sectors benefiting from long-term secular trends like technology and communication services make up 41% of the S&P 500 today compared to just 10% in 1957.

International investments don’t provide the same diversification benefits they once did.

Prior to 2000, there was a low correlation between US and international stocks. Meaning, when one zigged, the other zagged. That’s no longer the case today. Whether it’s from the introduction of the European Union that homogenized 27 unique economies and currencies or the rise of global trade, international equity markets are now highly correlated to the US. Not only have they failed to diversify to the same degree, they have also significantly underperformed domestic markets over recent decades.

Technological disruption presents a new risk to “value” stocks.

Traditionally, value investors could buy low valuation stocks with the expectation that their earnings would eventually rebound as the business cycle improved along with share prices. That’s become much more complicated over recent decades due to disruptive technologies that threaten the long-term existence of certain businesses. Today, investors must assess whether a stock is truly cheap or is at risk of meeting a similar fate of newspapers or travel agents.

Digital companies are deferring profits in exchange for scale.

With Amazon, Jeff Bezos was one of the first to recognize the scale capability of the digital economy. He broke the traditional rules by reinvesting the majority of profits back into the business to reach scale much faster than his competitors. Many have since followed this strategy, including Salesforce, Netflix, Spotify, etc. This has befuddled many traditional value investors as simplistic valuation techniques fail to recognize this business strategy, allowing them to only see the value in hindsight.

We’ll finish our thoughts with a quote from the legendary Warren Buffett.

“Investors should be skeptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the models. Beware of geeks bearing formulas.”

The opinions expressed are those of Harrison Financial Services as of November 14, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Past performance is not indicative of future performance. Diversification and strategic asset allocation do not assure profit or protect against loss.