One of Wall Street’s dirty little secrets is that much of its forecasts are based upon “mean reversion”. In other words, whatever hasn’t been working will reverse, or vice versa. We’ve heard this for years regarding international stocks versus US, value versus growth, corporate profit margins peaking, etc. It’s like some believe that there is some pre-ordained law that everything will gravitate toward its long-term average. In an era of innovation and change, we don’t think this holds much water.

Now we’re hearing a similar thesis regarding small cap(italization) stocks. This area of the market has meaningfully lagged during this bull market for a variety of reasons, most notably tepid sales and earnings growth. However, it’s become the trendy call among market strategists over the past year. Is there reason to believe that small caps are posed to outperform – finally? We have our own thoughts that go a bit deeper than the “mean reversion” thesis we’ve seen from others.

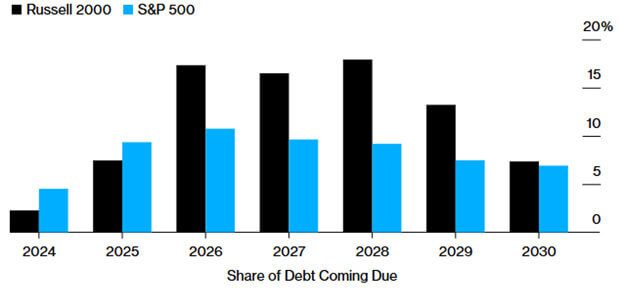

Refinancing Risk

Small caps have a relatively bigger share of debt coming due in next five years

Source: Bloomberg

One of the biggest headwinds for small cap stocks is the rise in interest rates. Smaller firms tend to use more debt because many have not yet reached the size necessary to generate enough internal cash flow to fund their investments and growth ambitions. They’re also more of a credit risk for lenders than their larger counterparts, so smaller firms don’t get the same borrowing terms. Instead, they lean more on variable rates with shorter durations that must be paid or refinanced sooner. In short, small caps are more rate sensitive, and a “higher for longer” environment is not ideal for this asset class.

Our second point is that small caps are much more cyclical than large caps. For example, the financial sector is the largest weighting in the Russell 2000 index at 19% vs. 14% in the S&P 500. Industrials are second at18%, which is twice the weight in the S&P. Our point is that not only are small caps paying higher interest costs, but their demand is also being impacted by rates.

Lastly, 2025 earnings expectations for small caps look ambitious. According to FactSet consensus, earnings for firms in the Russell 2000 index are expected to rise 40% next year. This compares to just 15% for the S&P 500. This is despite the sharp rise in interest rates that we’ve seen over recent months. We’ve seen this movie before. Coming into 2024, consensus was looking for a 25% rise in Russell 2000 earnings. Now they’re expected to fall roughly 8% this year. Investors thought they were paying a price-to-earnings ratio of 22x. Instead, they paid closer to 36x. We’re concerned that something similar could happen in 2025, especially with the recent rise in interest rates.

“Mean reversion” is not a sustainable investment thesis. It may work over short periods of time, but it’s usually not sustainable. This is especially true if key variables have changed. HFS believes that interest rates will remain “higher for longer”, which means parts of the market will likely not perform the same way that they have during the past 15 years. We’re not against small caps, but we believe some are better positioned than others to thrive in this changed environment.

The opinions expressed are those of Harrison Financial Services as of November 26, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. Any views on the relative attractiveness of different asset classes are made in the context of a well-diversified portfolio, not in isolation. They do not constitute individual investment advice and are not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Diversification and strategic asset allocation do not assure profit or protect against loss. Indexes and/or benchmarks are unmanaged and cannot be invested in directly.