Last week, Chinese stocks went on a historic run due to new government stimulus measures to jumpstart its ailing economy and real estate market. That government announced multiple interest rate cuts, reduced reserve requirements for banks, lowered mortgage rates on existing homes, providing funding to buy back stocks, and more. In just five days, China’s CSI 300 index rose over 25%, which is a record. Over the same period, its broader Shanghai Composite Index climbed over 21%, the strongest since 1996. After languishing near multi-year lows months ago, Hong Kong’s Hang Seng Index is now Asia’s best performing stock market in 2024, dethroning Taiwan. To top it off, David Tepper, a famous US hedge fund manager, did an interview on CNBC where he said to “buy everything” in China. Should long-term investors follow?

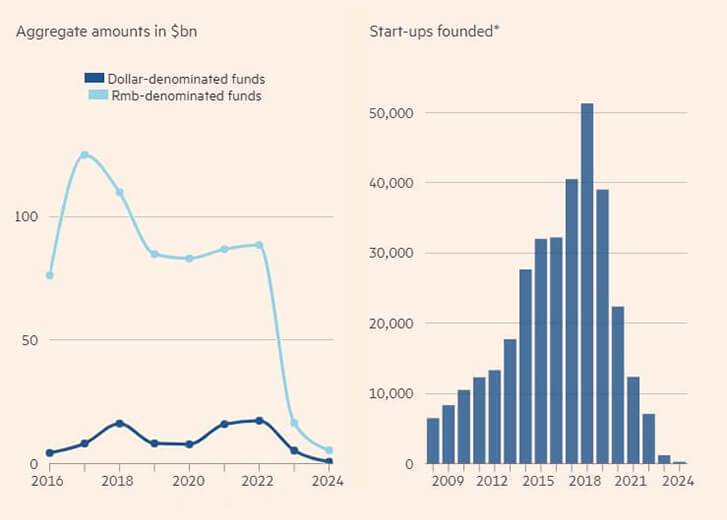

Overseas and domestic VC fundraising for China have fallen, as the country’s entrepreneurs shy away from launches

VC=venture capital, Rmb= renminbi

Sources: Preqin; IT Juzi • 2024 data ends in August and is incomplete; funding data is YTD

*includes start-ups that have received VC backing, plus some in areas that are a focus for VCs even if they have not received financing

We’re skeptical. China has many self-inflicted issues to overcome. After opening up its economy to foreign investment and embracing a market-based economy during the 2000s, President Xi and the Chinese Communist Party have burned a lot of bridges over recent years. It has cracked down on its technology industry with sweeping regulations that disrupted businesses, levied large fines, caused mass layoffs, and even forced key founders to flee the country. This has torn apart its previously budding start-up industry, which is shown in the chart above. To have this happen during the emergence of crucial new technologies like artificial intelligence is problematic for this global superpower.

Furthermore, China’s population is declining due to its “One Child Policy” that didn’t end until 2015. In fact, estimates project that China’s population is expected to decline by over 200 million people over the next 30 years. Not only will this weigh on economic growth but also its overbuilt real estate sector. Economists now estimate that China may have 90 million empty housing units. Assuming three people per household, that’s enough for the entire population of Brazil. Multi-national companies have been diversifying their supply chains away from China since the pandemic, and President Xi just reiterated his vow to “reunify” with Taiwan – by force if necessary.

Sure, Chinese stocks are cheap, but they’re cheap for a reason. We believe China’s issues are structural and can’t be fixed with monetary and fiscal stimulus. To us, this seems more like a trade instead of a long-term investment.

The opinions expressed are those of Harrison Financial Services as of October 2, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. Any views on the relative attractiveness of different asset classes are made in the context of a well-diversified portfolio, not in isolation. They do not constitute individual investment advice and are not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.