“Unprofitable tech.” It’s a phrase we’ve heard a lot over the past 15 years during the rise of the digital economy. Oftentimes, it is used as a knock against “growth” investing or a sign of a broken or overvalued business model. We heard such proclamations in the early days of Amazon, Netflix, Salesforce, Uber, and many others. We were reminded of this recently with reports that privately held OpenAI doesn’t expect to reach profitability until 2029, incurring losses of $44 billion between 2023 and 2028. If such companies are losing money, what’s the point? How can you even value them? Traditional value investors seemed bewildered, and often times, disgusted. Many just chalked up the existence of such bizarre anomalies to the Fed’s low-interest rate policy.

What some fail to realize is that this is intentional. These aren’t unprofitable business models. Quite the opposite. Inherently, selling a byte of software code is incredibly profitable and requires minimal human and financial capital relative to firms in the traditional economy. Rather, many digital companies choose scale over profits to establish network effects and market share.

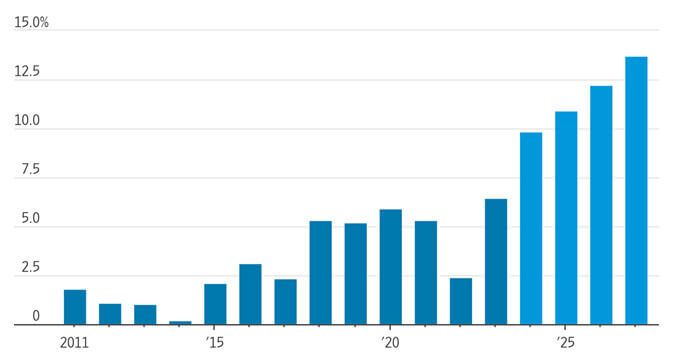

Amazon's operating income as a percentage of annual revenue

Note: Data for 2024-27 are projections.

Source: the company (actual); FactSet (projections)

Some economic laws don’t apply to digital firms in the same way as traditional ones. There is a concept called the law of diminishing marginal returns. In layman’s terms, this means that the more product a business produces, the less valuable each incremental unit becomes. If John Deere flooded the market with combines, it would become oversupplied and prices would fall. The same would happen with many others, such as Coca-cola, Proctor & Gamble, or Johnson & Johnson. However, the opposite is often true in the digital world. The more people that Meta’s Facebook or Instagram attracts, the more valuable that product becomes for both users and advertisers. The same is true for Ebay, Netflix, Amazon, Salesforce, etc. Unlike some firms that sell physical units, digital products tend to become more valuable over time as new features and users are added. This necessitates a re-prioritization of profits versus scale.

Like other digital firms, there will be a “prove it” moment for OpenAI. Just don’t confuse the financial modesty of these companies with broken or overvalued business models. We believe in yielding patience and looking beyond near-term profits and valuation multiples.

The opinions expressed are those of Harrison Financial Services as of October 10, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Past performance is not a guarantee of future performance.