There’s no such thing as a free lunch. This is what comes to mind when clients ask us about structured products. These are highly-customized and complex securities that are often sold with the promise of limited downside risk yet attractive upside –like a hybrid between a stock and bond. They are called “structured” because they reshape the original investment’s risk/return profile. For example, a structured product may advertise having 150% upside of the stock market and only 90% of the downside. However, the devil is in the details. Structured products take many different forms but usually involve purchasing a bond and then using derivatives (options, futures, swaps, etc.) to tie performance to a specific or group of assets, such as a stock index, currency, or commodity. While they make look compelling on the surface, some investors fail to understand their complex payoff structures, high fees, low liquidity, and unfavorable taxation. Many times, investors would have just been better off owning a combination of stocks and bonds instead.

Here are some key aspects of structured products to be aware of.

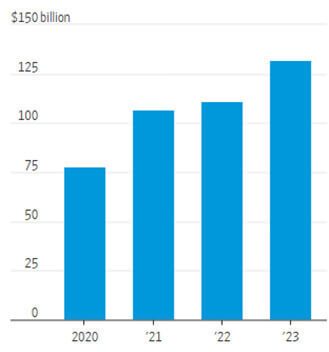

U.S. structured products, sales volume

Sources: Structured Products intelligence, WSD

High Fees

One primary reason that structured products remain popular among financial professionals is that they carry high fees and commissions. It’s not unusual to see annual fees on structured products in the 1.5% to 2.0% range, which is meaningfully higher than the average ETF (exchange traded fund) or mutual fund.

Understand the Opportunity Cost

Opportunity cost is the potential gain from other options that weren’t chosen. A big draw for structured products is that they can limit downside risk. However, there’s a tradeoff. Structured products cap the upside potential as well, which can be significant as we’ve seen recently in the stock market. These securities are also time constrained, meaning that the desired move in the underlying asset must occur withing a certain period. Yes, stocks can be volatile, but they can be held indefinitely and theoretically have unlimited upside potential.

Low Liquidity

It’s incredibly difficult to get out of a structured product early. The SEC noted, “A liquid market for structured notes does not exist. If you want to sell your structured note before it matures, you might have to do so at a price less than the amount you paid for it, or you may not be able to sell it at all.”

Unfavorable Taxation

Many structured products are treated as debt instruments, so gains are taxed at the ordinary income rate – not the capital gains rate. High fees coupled with a 30%-plus tax rate for high-net worth individuals makes the risk/reward difficult for such investors.

In our opinion, there’s usually always a better solution than a structured product. We’re not aware of any investor that compounded their way to wealth using these instruments. Structured products put a high price on managing volatility that oftentimes is not worth it.

The opinions expressed are those of Harrison Financial Services as of October 30, 2024 and are subject to change. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Diversification and strategic asset allocation do not assure profit or protect against loss. This article is not intended as tax advice. Taxpayers should seek advice regarding their particular circumstances from an independent legal, accounting or tax adviser.