Investors go to great lengths to manage risk. We diversify, allocate to bonds, consider valuations, use hedging strategies, among other tactics. This is usually all done in the name of limiting volatility since few enjoy watching their life savings gyrate wildly up and down. We also know that long term investing is a winning strategy. This is exactly why many want to manage volatility – a smoother ride reduces the chance of jumping off from motion sickness at an inopportune time.

However, there is a cost to risk management – it reduces returns. Investors can be too diversified or allocate too much to lower volatility securities that won’t meet their retirement needs. HFS only knows of one form of risk management that doesn’t impact returns – education. This is the primary purpose of our Weekly Market Commentary. We believe that the more people understand their investments or capital markets, it gives them perspective and reduces the chance of pulling the proverbial rip cord.

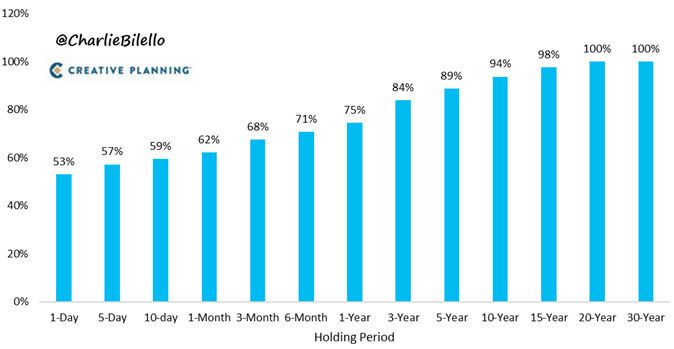

This week’s lesson; historically, stocks go up.

S&P 500 Total Return: % Positive (1928 - 2023)

Most probably understand this, but a periodic reminder is necessary. Financial media and pundits tend to focus on the negative or possible dangers lurking around the corner. Much of this scaremongering is self-serving. As the saying goes, bears sound smart but bulls make money. For over 95 years, there aren’t many things as consistent as positive returns for the S&P 500. Importantly, the longer you stick around, the greater your chances are. If only Las Vegas had such odds.

Managing risk is important, but we’d take patience and perspective over any hedging strategy.

Past performance is not indicative of future results. The opinions expressed are those of Harrison Financial Services as of December 5th, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. Any views on the relative attractiveness of different asset classes are made in the context of a well-diversified portfolio, not in isolation. All investments carry some level of risk, including the potential loss of principal invested. Diversification and strategic asset allocation do not assure profit or protect against loss. Indexes and/or benchmarks are unmanaged and cannot be invested in directly.