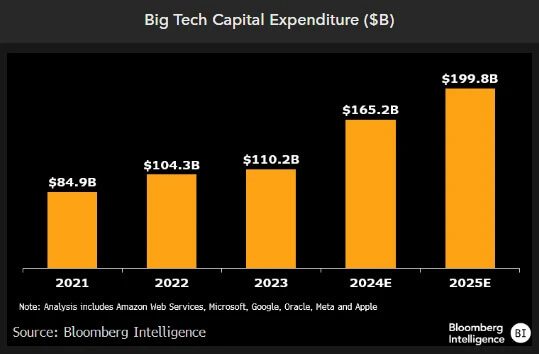

HFS believes that artificial intelligence (AI) will become one of the greatest technological innovations in modern history. It’s not just us who believes that – there are a lot of brilliant technology CEOs that are also making big bets that this happens. While many are struck about the size of the investment being made in AI, what impresses us more is the environment that this is happening in. Capital is no longer cheap. Pre-pandemic interest rates are nowhere to be found. Investment hurdles have been raised. Because of this, Wall Street is rewarding “profitable growth” and being critical of investments without clear and immediate returns. Yet, big tech keeps accelerating this unpopular and massive investment. In fact, the theme we’ve heard from listening to big tech’s 3Q24 earnings calls is that AI demand continues to outstrip their capacity. They can’t build it fast enough.

During periods of scaling investments, returns can be murky and tough for outsiders to see. This is because any initial benefits get masked by even more investment. We saw this in the early days of Amazon, Tesla, Netflix, Spotify, among others. However, big tech offered plenty of examples of AI benefits during recent earnings calls:

- Amazon’s AI cloud computing unit is a multi-billion revenue business that continues to grow at a triple digit percentage rate and is growing more than three times faster at this stage than its initial cloud computing business.

- Meta is seeing AI have a positive impact on nearly all aspects of their work. AI-driven content recommendations led to an 8% increase in time spent on Facebook and a 6% increase on Instagram.

- Microsoft’s AI business is on track to surpass an annual revenue run rate of $10 billion next quarter, which will make it the fastest business in the company’s history to reach this milestone.

- Alphabet spoke about how Audi used its AI tools on an advertising campaign that increased website visits by 80% and increased clicks by 2.7x, which accelerated that company’s sales.

We think Meta said it best – AI is having a positive impact on nearly all aspects of work. It’s not so much a product but a feature to supercharge growth of trends that already exist, whether that’s cloud computing, digital advertising, e-commerce, or autonomous driving.

At HFS, we believe investing into this powerful secular trend will prove to be a generational opportunity. Big tech agrees.

The opinions expressed are those of Harrison Financial Services as of November 6, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested.