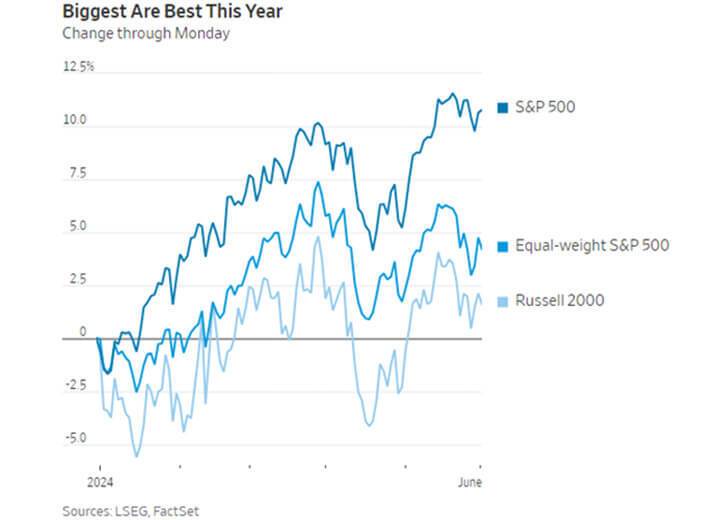

Unlike others, HFS has long been arguing that the stock market (the S&P 500) doesn’t need a rate cut. Rather, it only needs to hear that the Fed is finished raising interest rates. We’ve based that argument on seeing the S&P 500 up double-digits year-to-date even though investors have meaningfully reduced their expectations for the amount and timing of future Fed rate cuts. This may seem foreign to some considering all the central bank intervention that’s occurred since 2008, but the Fed has had little to do with this rally. Instead, market strength has been fueled by good old-fashioned earnings growth.

However, there are parts of the market that do need lower interest rates. Small and medium-sized stocks are one of them. Compared to larger companies, smaller firms tend to be more cyclical and vulnerable to economic change. They are generally less profitable and more reliant upon external financing. This is unlike many larger companies that can choose to fund their investments from internally generated cash. Thus, the Fed’s rate hikes have been more impactful to smaller firms, and stock prices are reflecting this.

Another major factor is that artificial intelligence (AI) has been a rich man’s game thus far. AI chips are incredibly expensive, costing upwards of 10x that of traditional computer chips. Also, most are designed by one firm (Nvidia) and largely manufactured by one company (TSMC). Demand is outstripping supply, so only the companies that can place the largest orders are getting access, largely leaving out smaller players. Even if a small business could get an allocation of AI chips, could they afford to make the necessary investment considering how much their interest costs have risen?

There are economic headwinds out there, but some firms are better equipped to overcome them than others. As the saying goes, it’s not a “stock market” but a “market of stocks”. Higher rates coupled with artificial intelligence has really benefited the largest components of the S&P 500 at the expense of the smaller ones. Small and mid-cap stocks are cheap, but they’re cheap for a reason.

Such divergence in performance isn’t a bad thing. In fact, it creates fertile ground for active stock selection and differentiated performance, which we welcome.

The opinions expressed are those of Harrison Financial Services as of June 6, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.