The German economy is in rough shape. After enduring a recession last winter, there are now fears that Europe’s biggest economy will re-enter yet another recession this year. Recent data showed that Germany manufacturing activity plunged at a rate not seen since June 2009, excluding the pandemic. The country is battling high and pervasive inflation, elevated interest rates, weak consumer spending, an energy crisis from the Russia/Ukraine war, and a meaningful slowdown in China – one of its most important trading partners.

The German stock market must be a total mess.

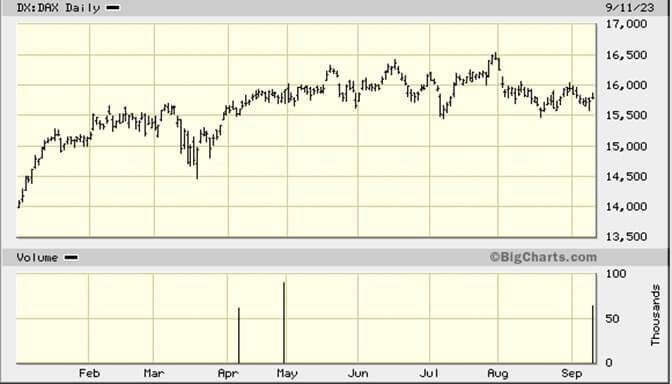

It’s not. In fact, it’s up over 13% year-to-date. Outside of a modest correction in March, it’s held steady despite all the negative economic data. Unlike in the US, the German stock market reached new all-time highs back in July, although it has since pulled back a bit from those levels. Imagine all those German economists and strategists who got their recession calls right but so woefully missed on the implications it would have on equity prices. Autsch! (“ouch” in German).

German Stocks Shrug Off Recession

Source: Bigcharts

We feel a valuable lesson can be learned here, especially considering the relentless calls for a recession here in the US. Too many investors equate economic health with corporate earnings and thus stock market performance. We believe that the stock market is a forward-looking discounting mechanism of future cash flows. In other words, what’s happening now matters less than what is expected to happen in the future. Last year, global stock markets rightly discounted that corporate earnings were set to decline. However, many overshot on the downside and have spent the better part of 2023 recovering from such dire predictions.

Furthermore, not all industries are as reliant upon broad economic growth to power their future earnings as they used to be. Instead, many enjoy secular growth that can take market share from legacy players even with a sluggish economy. If those companies happen to account for a high percentage of a stock market like they do in the US, then broad economic growth matters even less to equity performance.

In short, investors shouldn’t let economists or strategists scare them with recession calls. Here in the US, we’ve already endured a nasty bear market. We’ve had a “technical” recession with back-to-back declines in quarterly GDP. We already had a “credit event” earlier this year with runs on sizable regional banks that made them insolvent nearly overnight. Unless there’s something big on the horizon that’s really going to take a meaningful cut to corporate earnings, it's hard not to believe that the worst is over for equities.

The opinions expressed are those of Harrison Financial Services as of September 14, 2023 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.