To convince someone to take on more risk, you typically must increase the reward. Same is true in the bond market. If someone is not considered creditworthy, or is becoming less so, the bond market is quick to sniff out such a potential credit risk and demand to be compensated through higher yields. After a prolonged period of both fiscal and monetary stimulus, the US government is running a sizable deficit and total debt has risen to record levels. However, outside of a brief period during the fall of 2023, Treasury yields have largely yawned. If fixed income investors are considered the “smart money”, then why isn’t the bond market concerned about our rising government debt? If the bond market isn’t bothered, is it really a problem?

The following charts were taken from a recent Wall Street Journal article, which gave some reasons why global investors continue to have a high appetite for US government bonds despite rising debt levels.

Reason #1 – Big investors need deep liquidity.

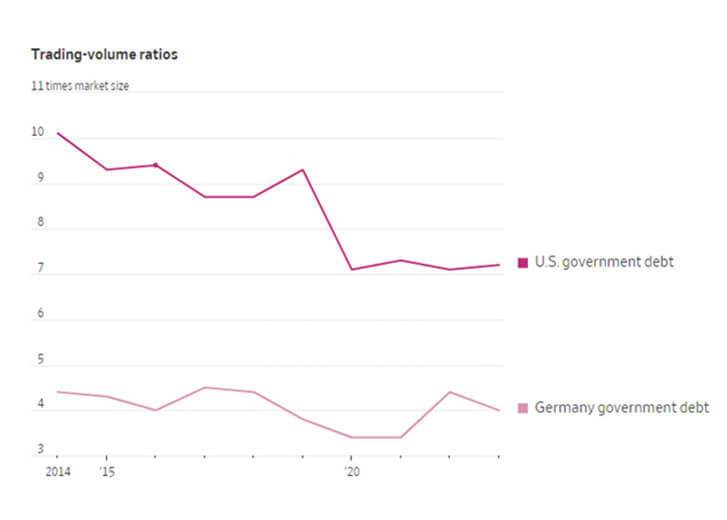

Liquidity refers to how easily an investor can buy or sell in a market without impacting the asset’s price. In 2023, about $190 trillion of US Treasuries traded, which was more than 7x the total amount outstanding ($27 trillion). While German bonds are also considered safe, the trading volume of these securities total just $7 trillion, or 4x the amount of bonds outstanding.

Notes: Shows ratio of trading volume to year-end volume of outstanding debt securities.

Some differences in trading volumes could be due to different reporting methods.

Sources: SIFMA (U.S.) Federal Republic of Germany; WSJ calculations

Reason #2 – Better bang for the buck.

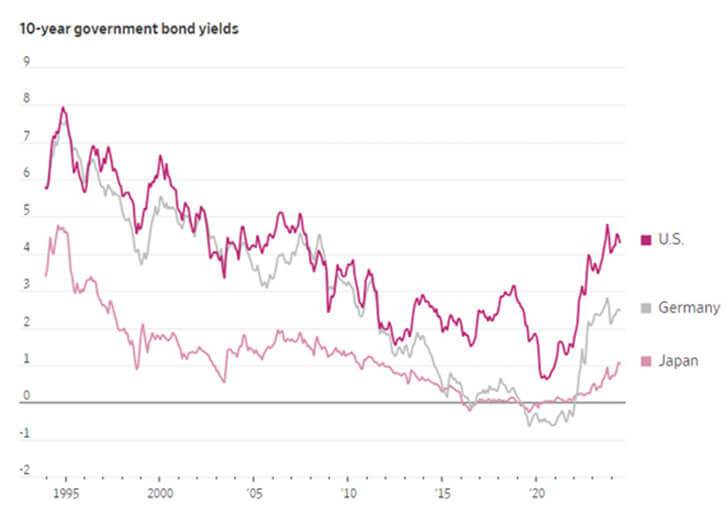

Treasuries also offer higher yields compared to other developed nations with high credit ratings, making them relatively attractive for global pension funds and life insurers. This is a function of having stronger economic growth, favorable demographics, and a lack of government borrowing in Germany. In fact, German bond yields just recently turned positive.

Source: Federal Reserve Bank of St. Louis

Reason #3 – The components of US debt appear less alarming.

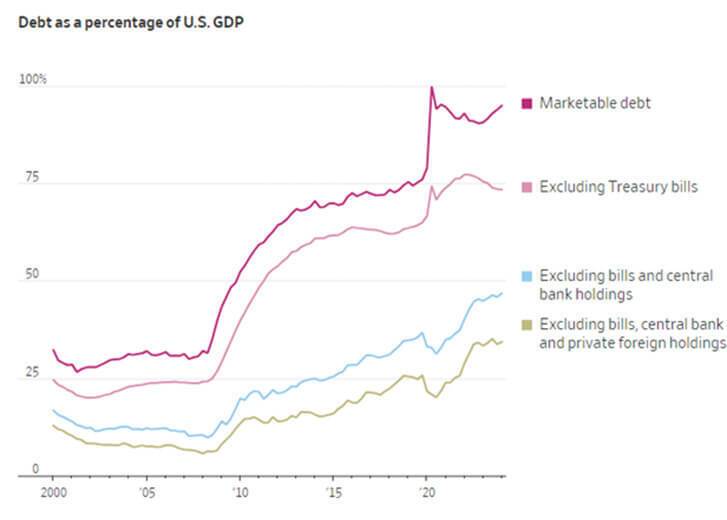

Certainly, US debt levels have risen significantly over the past 15 years. However, if we exclude ultrashort-term debt (Treasury bills) that investors consider “safe” and central bank holdings (Federal Reserve and foreign central banks) as a result of quantitative easing, we see a different framing of our debt relative to our GDP (gross domestic product).

Sources: Federal Reserve Bank of St. Louis (debt held by public); Brad Setser (other categories)

Despite the negative connotations, debt is not bad. It’s a necessary component to capitalism and our capital markets. However, just like many things in life, too much of it is not healthy either. During this election season, there will be a lot of political posturing on this topic. Our view is that our deficit needs to be addressed, but it’s not the looming disaster that some make it out to be. Instead, we’re watching the people that are investing enormous sums into US Treasuries. For them, it appears business as usual.

The opinions expressed are those of Harrison Financial Services as of July 17, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment.