Stocks have stumbled recently, and that’s ok. This is why the asset class has offered the highest long-term returns for over a century compared to bonds, gold, commodities, etc. They’re more volatile, and not everyone can stomach the ride. This is the reason we spend most of our time educating clients about what matters, and more importantly, what doesn’t. History shows that the most important thing is sticking to your financial plan and remain invested. This is easier to do in some periods than others. However, understand that without such volatility, future stock returns would likely be reduced. Just like exercise, pullbacks are uncomfortable but healthy.

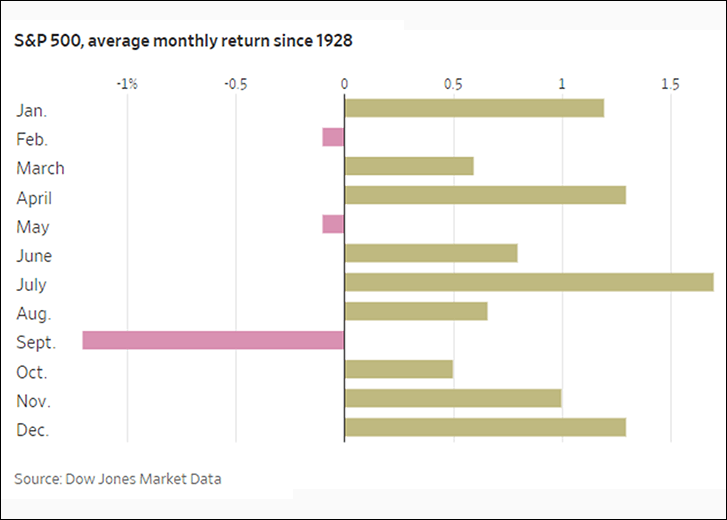

For us, there is nothing unusual about this ramp in volatility. Perhaps coincidence, but it’s a common phenomenon this time of year. We’ve yet to hear a great explanation, but September hasn’t been a great month for stocks over time. In fact, September has been a down month for four years in a row and has declined 56% of the time since 1928.

We encourage investors to keep perspective. The S&P 500 is still within striking distance of all-time highs. It’s on track for two consecutive years of double-digit gains. Since the October 2022 lows, the S%P 500 has climbed nearly 60%. It’s up 35% from October 2023. Corporate sales and earnings growth continue to rebound, although not evenly across all firms and sectors. While stocks benefiting from artificial intelligence have also pulled back, we see continued fundamental strength for multiple years. The Fed’s next move is likely a rate cut. While the job market is cooling/normalizing, so is inflation.

Despite this fit of volatility, things look good in equity land. It’s part of the package.

The opinions expressed are those of Harrison Financial Services as of September 12, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.