The Fed began its latest rate-cut cycle this past week, cutting by 0.50%. Historically, when this occurs without a recession, stocks do well. At HFS, this is our base case. In fact, we think we’re no where near a recession for the broader economy, although smaller parts of it are struggling. However, what does this rate-cut cycle mean for bonds? If the Fed is lowering interest rates, won’t those falling yields produce attractive price returns for longer duration fixed income? As Lee Corso likes to say, “Not so fast my friend”.

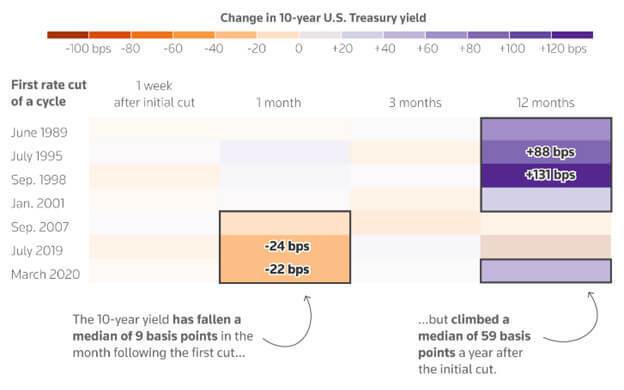

As the chart below shows, longer term bond yields tend to rise after rate cuts. This is due to the expectations that lowering the short-term cost of money will produce higher growth and inflation over time. If you’re confused, you’re not alone. A common mistake is the assumption that the Fed controls the entirety of the yield curve. That is, bonds across all durations, whether one year or 10. While the Fed has a material influence on all yields, this erodes the further out you go. In other words, central banks may have a high impact on one-to-two-year bond yields, but as we move further out, market forces begin to take hold. As short-term rates fall, the tendency is for long-term rates to rise.

Dip and rise

Yields for benchmark Treasuries have generally been higher a year the first cut.

Source: CrediSights

We feel that this historical tendency is especially meaningful today because things are moving in the opposite direction. Recently, bond yields have fallen sharply. The US 10-year Treasury yields peaked in 2024 at 4.7% in April but now sit below 3.7%. The market is pricing in 10 rate cuts worth 0.25% each. To us, bonds seem to be pricing in a return to pre-pandemic times and inflation is a past relic.

We see it differently for several reasons. First, the Fed isn’t cutting because it wants to heal the economy from a recession or panic. Despite restrictive interest rates, economic growth remains healthy, albeit slowing. As rates are lowered, we see longer-term growth assumptions climbing higher and expect longer-term yields will follow. Secondly, we think 10 rate cuts is a stretch. The last thing the Fed wants to do is revive inflation and have to reverse course. Lastly, the geopolitical climate has changed since the pandemic. Diversifying supply chains out of China to other regions improves security and reliability but also increases costs. We believe that there are notable inflationary forces that will keep yields elevated for longer than the market expects currently.

With all the talk from the financial media about the valuations of tech stocks and artificial intelligence beneficiaries, we see long-term bonds as being richly priced. In fact, if we convert the 10-year US Treasury yield to a comparable “Price-to-Earnings” ratio (price-to-yield), it trades at 27x. Unlike equities, that’s guaranteed. However, it also guarantees no growth or inflation adjustments.

At HFS, we still think we’re in a “higher for longer” rate environment, despite the Fed’s move this past week. Bonds seem to be priced otherwise, which is why we’re titled away from longer duration fixed income and towards bonds that are less rate sensitive.

The opinions expressed are those of Harrison Financial Services as of September 19, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. Any views on the relative attractiveness of different asset classes are made in the context of a well-diversified portfolio, not in isolation. They do not constitute individual investment advice and are not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Past performance is not a guarantee of future performance.