There are many nuances to markets and economics. Often, these can confuse those that don’t live and breathe it every day. A company can “beat” quarterly earnings estimates and still see its stock fall. An economy can fall into recession while its stock market hits all-time highs. The Fed can say that there’s been progress on its inflation fight, but prices at the grocery store are as expensive as ever. What often gets lost on outside observers is that in markets and economics, it’s rarely about the current state of things. Rather, it’s about the rate of change and what that means for the future. In short, are things getting better or worse?

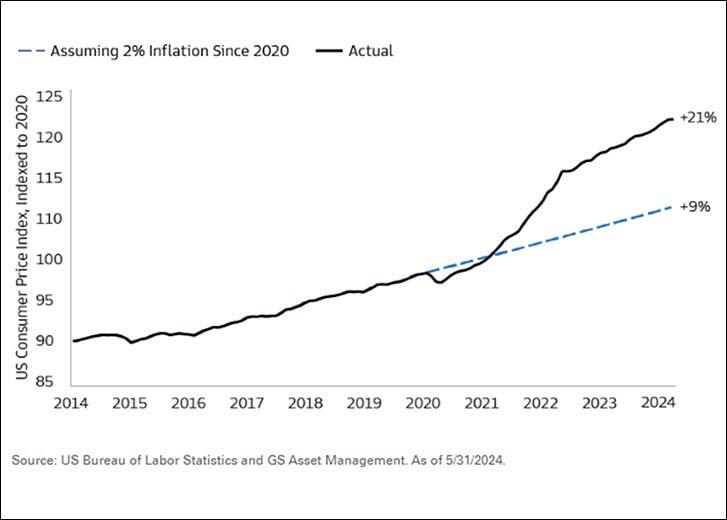

Inflation is a rate of change metric. It’s not a measure of absolute prices but of how much they’re rising (or falling). Also, inflation tends to defy the laws of gravity. What goes up rarely comes down. This is what is shown in the chart above. The inflation that resulted from the 2020 pandemic has increased the consumer price index (CPI) by 21% cumulatively. Had it kept its pre-pandemic trend, prices would have been only 9% higher. They are unlikely to revert back to the lower trendline. Rather, the Fed’s goal is to drive inflation down to a 2% rate at these higher levels.

HFS understands that this is a very bifurcated market and economy, which isn’t that unusual during periods of recovery. Perhaps it is more pronounced with higher interest rates and secular trends benefiting some but not all.

Until the Fed conquers inflation and loosens their economic noose, it will likely remain this way.

The opinions expressed are those of Harrison Financial Services as of June 21, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice.