Diversification helps manage risk. Simply put, by not putting all your eggs (money) into one basket (security), you can reduce both volatility and the odds of recognizing a loss. The idea is that you want to give your portfolio multiple ways to win. However, it’s not just about increasing the number of securities in your portfolio – being too diversified can hurt returns. You also want your investments to behave differently from one another. Ideally, when one zigs, you want others to zag. This is what happens when two investments have a low correlation. If the correlation is high, then you just have securities that behave alike, which defeats the purpose. The goal is to build a portfolio that is diversified without having a major impact on returns.

This brings us to our topic of the week – do international stocks still diversify? We know that their performance has lagged meaningfully. Since 1995, the annualized return of the S&P 500 has been 10.7% compared to just 5.8% for a common benchmark of international stocks, the MSCI ACWI ex US. That’s roughly 30 years of meaningful underperformance. However, many “experts” argue that while overseas stocks have lagged, they still provide diversification benefits. While this may have been true decades ago, the data shows otherwise.

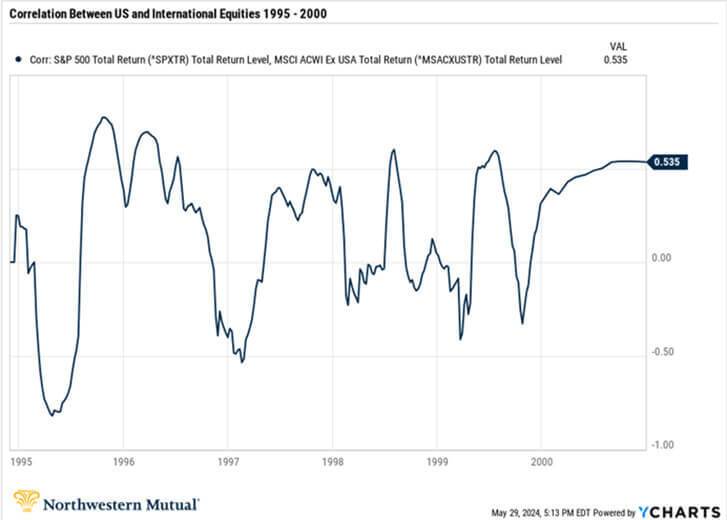

Here's the proof as we see it. The chart above shows the correlation between the S&P 500 and the MSCI ACWI ex US benchmarks from 1995 to 2000. As you can see, the correlations are often below 50% with many years being negative, which means that when one group of stocks were up, the other were down. Again, a negative correlation is a very good characteristic for diversification.

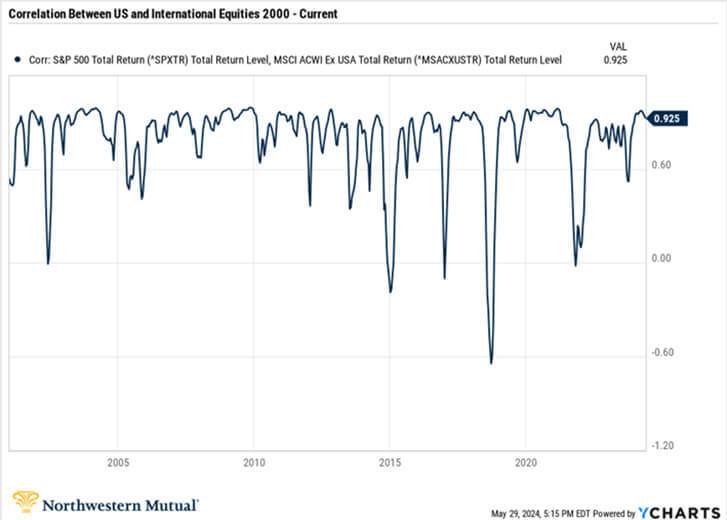

When we look what’s happened since 2000, we can see how correlations have meaningfully increased. While there are brief periods where it drops, it generally rises back up over 90%, which is where it sits currently. The reason why is debatable. Certainly, the rise of global trade has likely been a factor, which contributes to the synchronization of the world’s economies. In fact, about 40% of the revenues from companies in the S&P 500 come from foreign countries, according to S&P Global. Another factor was the adoption of the Euro currency in 1999 and the creation of the European Central Bank, which morphed much of Europe’s independent economies, central banks, and currencies into one.

While international stocks used to offer great portfolio diversification, things have changed. Today, the asset class has largely offered only low returns. While that could change, we see more of the same for a host of reasons. Those that still champion their diversification characteristics are either clinging to outdated research of a world that no longer exists or are financially incentivized to promote allocations overseas. If you think we’re being too cynical, just simply compare the internal expenses of an international fund to a similar one based in the US.

The opinions expressed are those of Harrison Financial Services as of May 31, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.