The Fed prognosticators were out in full force this past week after the Board cut interest rates for the first time since March 2020. We heard a lot of talk about what it means and why the Fed decided to cut by 0.50% instead of the more typical 0.25%. Some felt it was too much, others felt it was just right, while the bears were quick to point out that Fed cuts typically happen at the start of a recession. Our thought is that not all Fed cuts are the same. Rates cuts are not always done to save an economy from tipping into recession. Without a recession, rate cuts have been very positive for the stock market, historically speaking. Context matters.

Source: GS GIR and GS Asset Management. As of September 20, 2024.

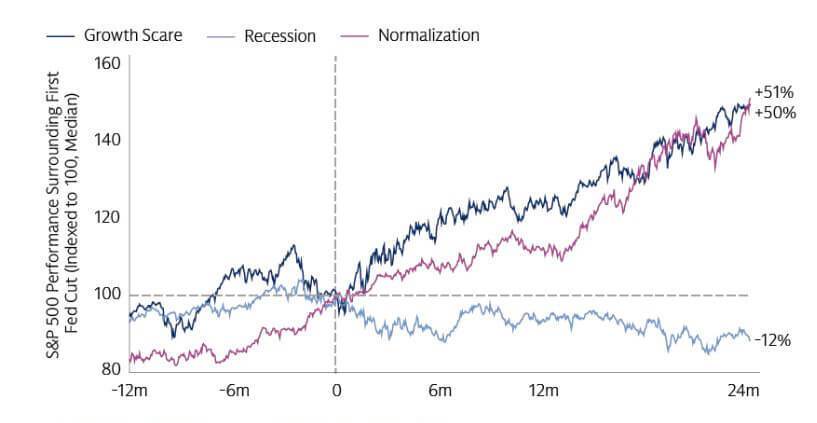

The chart above is a clear illustration of this. It shows how the S&P 500 has performed after the Fed begins a new cycle of rate cuts under three different scenarios: if it was done to normalize rates, to fend off slowing growth, or to dig out of a recession. It’s not so much about the action (a rate cut), but the reason for it. The only time a new cycle of rate cuts has been negative for stocks is when the Fed is too late and the economy dips into recession.

Like we’ve been saying for over a year, we see very low chance of a recession. Our confidence on this front has only grown. Corporate sales and earnings are accelerating, massive investment is being made into artificial intelligence and other emerging technologies, and the job market remains healthy, albeit slowing. This isn’t just our opinion. Here are some recent quotes from corporate management teams during investor calls about the state of the US consumer:

- “I think the consumer is in a reasonably strong shape, and it’s been true for quite a while.” – Capital One Financial CFO

- “I think most people are still doing pretty well, whether it’s on the consumer side or the commercial side.” – Wells Fargo CFO

- “We believe that consumer spending remains healthy…if you compare the trends and what we saw in July and the trends, what we see in August, they are very consistent.” – Mastercard CEO

- “The consumer is actually in pretty good shape. We can see their balances in their account. We can see on the loan side, delinquencies. And there’s been no abrupt changes there.” – Regions Financial CFO

The theme for these post-pandemic times continues to be “normalization”. In our opinion, this is the Fed’s rationale for cutting rates by 0.50% last week. Now that growth and inflation has normalized, it’s time for Fed rates to do the same.

The opinions expressed are those of Harrison Financial Services as of September 25, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment.