There has been a lot of confusion and angst about this market recovery. Many believe it’s unhealthy because it’s been largely driven by only a select handful of stocks. Others are clinging on to inverted yield curves and economic surveys hoping that the recession they’ve been expecting for two years finally materializes. Those like us understand that various parts of our economy are simply on a different cadence now. It’s just a matter of time until the remaining 493 companies in the S&P 500 start carrying their own weight, and it looks like that’s set to happen sooner rather than later.

EPS=earnings per share (a measure of a company's profitability)

Magnificent Seven=Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla

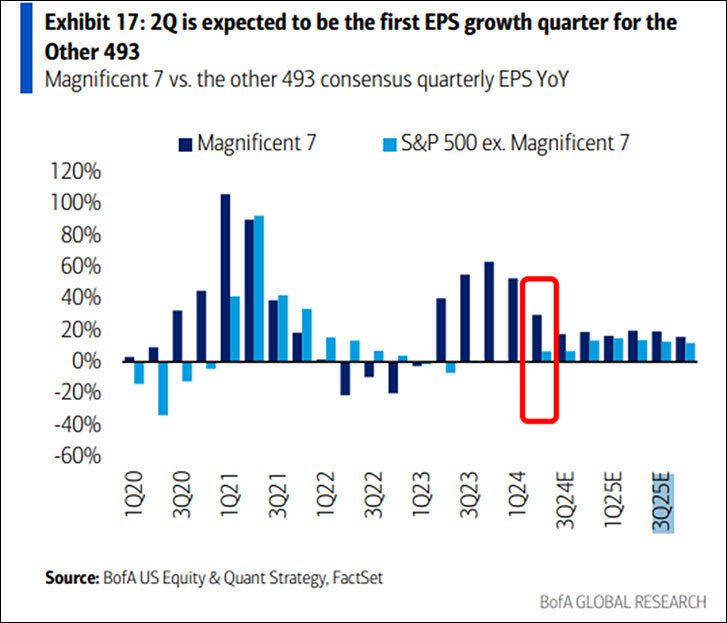

The chart above shows that earnings growth is expected to broaden out beginning in the 2Q24. In fact, it would be the first time since the 4Q22 that the other 493 firms in the S&P 500 would come out of their earnings recession and collectively grow profits. Many of these companies tend to be more sensitive to interest rates, so they could have an additional tailwind should the Federal Reserve decide to cut rates soon.

A lot of things have changed since the pandemic. Perhaps shutting down the “real” economy and pushing that activity to the “digital” one has forever changed the cadence of certain sectors. Remember, the technology sector was one of the first to enter a bear market in 2022, and they were the first to lead us out the following year.

Now it’s time for the rest of the market to step up. The backs of the Magnificent 7 are tired of carrying all the weight.

The opinions expressed are those of Harrison Financial Services as of July 10, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Past performance is not a guarantee of future performance.