We’ve heard that fixed income investors are often called the “smart money”. Most bond investors tend to be sophisticated institutions, such as corporations, governments, and other large purchasers that can be very risk adverse and thoughtful capital allocators. Meanwhile, the stock market tends to have a higher participation from retail investors with less experience. Bonds generally don’t attract the “get rich quick” crowd like stocks do, so we can argue that there’s “more signal, less noise” implied in bond prices. We know that stocks went into full panic mode last week, which caused all the bears, “recessionists”, and financial media to speculate that the Fed had kept interest rates too high for too long and that an economic downturn could (finally) be on its way.

Meanwhile, the “smart money” sighed.

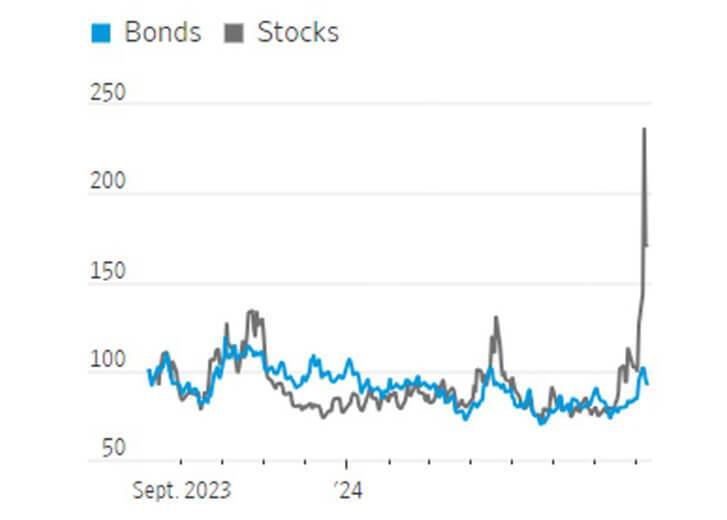

Bonds have been mostly insulated from the volatility storm

Implied volatility indexes

100 = Aug 8, 2023

Sources: ICEBofAML MOVE Index via LSEG(Bonds),

Cboe Volatility Index (Stocks)

Bonds did react, but in a much more measured fashion. Fixed income spreads, or the incremental amount that investors demand for taking on credit risk, did widen (increase) – an acknowledgement that risks were rising after a tepid jobs report. However, it was a small move, even in the riskiest parts of the bond world. High yield spreads increased to 3.81 percentage points, which was the highest since last November. In just a week, that spread compressed to 3.4 percentage points. Notably, this spread still implies a default rate in high-yield bonds of 5.7% despite actual defaults falling to 4.06% in June, according to Fitch. In other words, the bond market is already conservatively priced relative to actual stress.

Remember, the bond market has a solid track record of being the first to sniff out oncoming economic stress. This occurred during the Global Financial Crisis in 2008 and then again during Europe’s Sovereign Debt Crisis that peaked around 2011. The “smart money” didn’t think much of the recent jobs report or other “tells”, such as the Sahm rule, inverted yield curves, sentiment surveys, or other “predictors” of economic doom.

For us, it just validates that the ensuing “volatility storm” was just a rapid unwind of a levered “carry trade” that had more to do with Japan than any signal of oncoming economic stress in the US.

Carry on.

The opinions expressed are those of Harrison Financial Services as of August 15, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.