Wall Street is a fickle bunch. First, they want growth – the higher the better. Then they start assessing how sustainable it is. Lastly, they start demanding returns on investment, or profits. It’s a natural cycle for most emerging businesses but one that seems to be growing shorter by the year. Investors want returns now, which waterfalls down to money managers and then to corporate executives that are largely judged by their stock performance. The word “patience” gets relayed back up the food chain, but it usually falls on deaf ears.

In our opinion, we are embarking on the “returns” part of the artificial intelligence (AI) cycle. Remember, the “ChatGPT moment” was less than two years ago on November 30th, 2022, and we really didn’t see it in Nvidia’s results until May 2023. Since then, we’ve seen massive investment into AI chips, data centers, and power. According to Coatue, there will be an estimated $180 billion of AI spend in 2024, and they expect this to become $1.2 trillion by 2030. Now investors are asking companies to “show them the money”. This question has been a common theme during recent corporate earnings calls – will it all be worth it?

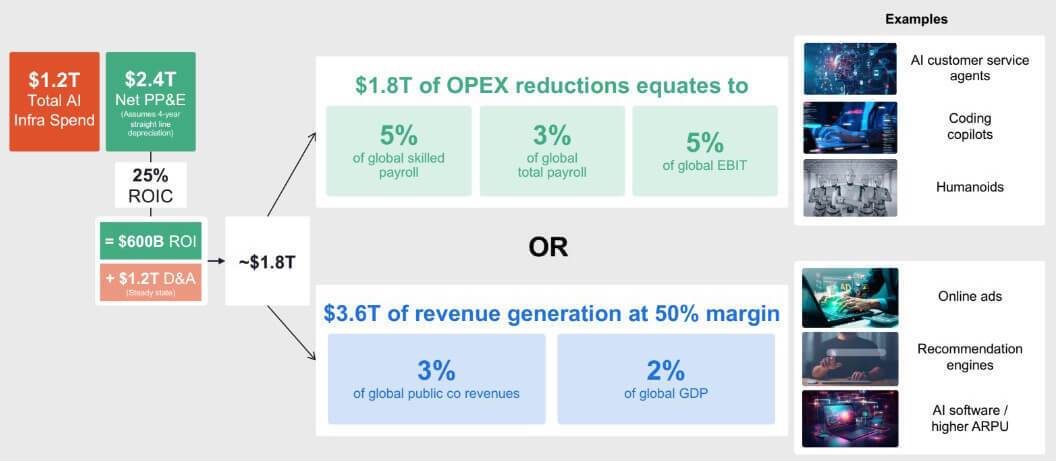

Is there sufficient potential value to justify the cost of AI?

Source: Coatue analysis of Bloomberg and S&P Global as of June 2024 (CapEx, IT Spend, all macro data); 2024 and 2030 GPU and AI Infra Spend estimates and corresponding assumptions per internal Coatue model as of date of this presentation and subject to change; model assumes that AI infrastructure costs are generally 1.5x computing costs. $1.5T is intended to represent the potential cost savings that would be necessary to justify the estimated AI infra spend for the purpose of assessing the feasibility of an AI Infra buildout and do not predict or imply that AI will create such saving. Headings and commentary represent Coatue opinion and analysis. For illustrative purposes only to illustrate Coatue’s current view of the potential Total Address Market (TAM) for AI infrastructure and whether this TAM could be realistic in light overall global IT spending, capex and GDP. Headings and commentary represent Coaue opinion and analysis. For illustrative purposes only to illustrate Coatue’s current view of the macro environment and potential overall AI Infra Spend, which is based on available data and subject to change at any time based on additional I formation received. Examples above represent a subset within each applicable trend and are not an exhaustive list or necessarily representative of current or future Coatue investments. There is no guarantee that Coatue’s views and projections regarding the future potential of AI are accurate or that any particular Coatue investment or fund will benefit from the AI trend. There is no indication or guarantee that any investment or fund will be successful or avoid losses. Information presented does not represent investment advice. See Appendix-Disclosures for important disclosures, including regarding AI.

There are two ways to generate returns: increase revenue or cut costs. We believe that AI has the potential to do both and on a large scale. The chart above shows how companies can justify the $1.2 trillion of AI investment that Coatue expects by 2030. First, it sets a high bar – 25% return on invested capital, which is well beyond what most firms would need to justify investment. This not only includes $1.2 trillion of new AI spend but also the cost of past investments ($1.2 trillion of depreciation & amortization). Effectively, this necessitates about $1.8 trillion in either higher revenue, lower costs, or a combination of both.

At first glance, this seems like a high hurdle to overcome. However, when framing this on a global scale, achieving these numbers becomes much less daunting. For example, $1.8 trillion of savings in operational expenses would be only 3% of the world’s payroll. On the revenue side, $1.8 trillion of gross profit ($3.6 trillion of incremental revenue at a 50% gross margin) equates to about 3% of revenue from global public companies (excluding private) or 2% of the world’s GDP.

In short, there is reason to believe that the math will work, despite the large numbers. The outstanding question is “when”? We have yet to hear of a public company that is cutting back on their AI spending. Everything that we hear from the engineering side of AI is that the technology continues to scale. In other words, more data and computing power is translating into more functionality and opportunity. This latter point is key. If there ever is an indication that scale benefits are maturing, we would question Coatue’s estimate of this market reaching $1.2 trillion by 2030. We could also make the argument that their forecasts could prove too conservative as well.

Nevertheless, a $180 million market becoming $1.2 trillion within 6 years translates to about 37% annual growth rate. We would argue that most Wall Street estimates are not factoring in such a scenario under current valuations.

At HFS, we’re laser focused on the AI opportunity with investment strategies that specifically target this promising technology.

The opinions expressed are those of Harrison Financial Services as of August 29, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. Any views on the relative attractiveness of an asset class are made in the context of a well-diversified portfolio, not in isolation. They do not constitute individual investment advice and are not intended as an endorsement of any specific investment or security. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Any returns referenced represent past performance and are not a guarantee of future performance.