Politics and elections bring out the passion in many of us. What’s right and wrong with our society and government, the way things were or should be, and who’s the leader to fix such issues. Politicians are increasingly capitalizing on this emotion with mudslinging and scary campaign commercials about the dire consequences if their opponent is elected. They make it seem like our world will be permanently impaired if they don’t win.

Source: Bloomberg and Goldman Sachs Asset Management. As of April 3, 2024

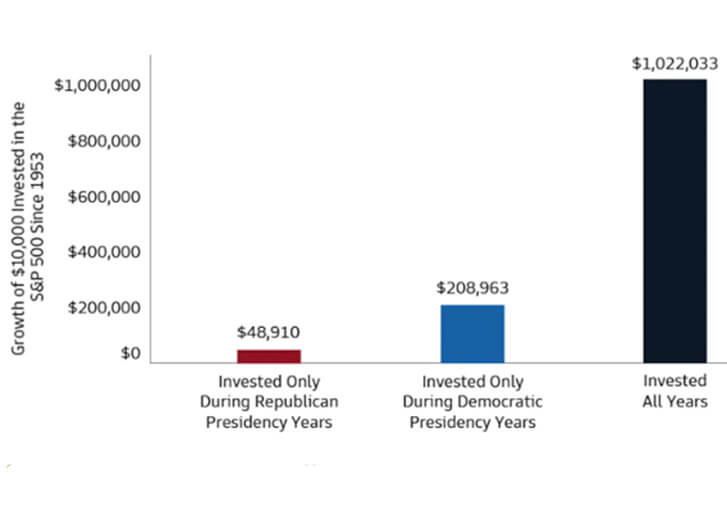

While many care deeply about elections, stocks generally don’t. Sure, there are always exceptions, like the energy, health care, and defense sectors that rely on government policy and regulation more so than others. However, even these impacts tend to be short lived. Ultimately, what matters is growth of future cash flows. Not just this year, not next, but indefinitely. Investors are trying to figure out how big a company can get before its growth becomes mature. A four-year term is a tiny speck of time in the corporate world where some firms have been around for 100 to 200 years.

At HFS, we encourage everyone should vote. However, they should do so at a polling booth – not with their investment portfolio.

The opinions expressed are those of Harrison Financial Services as of April 26, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Any returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.