Price is what we pay. Value is what we get in return. That’s the issue with international equities. Sure, they’re less expensive than US stocks (and have been for many years), which often makes them a “top pick” for many market strategists hoping that their discount with the US will close. However, in our experience, “they’re due” is not a profitable investment thesis.

If we peel back the layers of the reasons why international stocks carry lower valuations, we begin to question how much value they truly offer. They’re more cyclical and interest rate sensitive with less exposure to big secular trends than what we’re blessed with in the US. International stocks have been growing earnings at a much slower clip as well. They’re more dependent upon China, which has proven over recent years that it’s no longer the economic growth engine that it used to be 20 years ago. In fact, large multi-national firms are beginning to diversify away from China for a host of reasons, including a potential conflict with Taiwan.

Source: JPMorgan

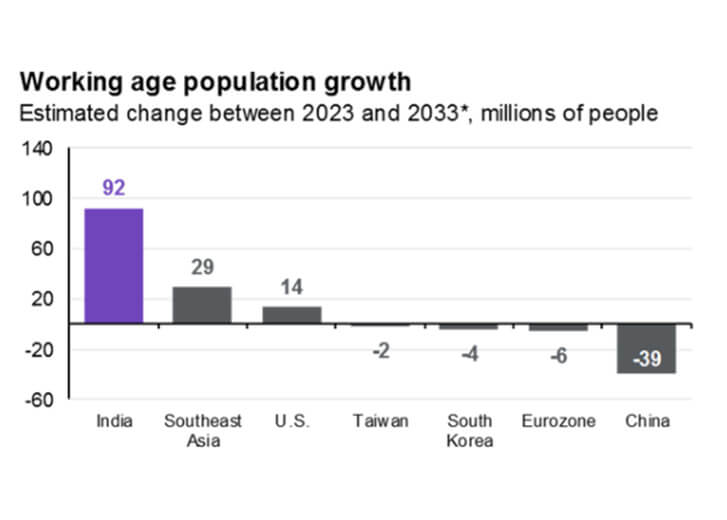

Another factor that’s looming is poor worker population growth. This is important because rising economic output is largely a function of two factors: increases in workforce and the productivity or output of that workforce. This does not bode well for future growth in major markets overseas. Over the next 10 years, China is expected to see a 39 million decline in people of working age due to its “one child policy” that lasted from 1980 to 2016. Europe is expected to lose 6 million. Workforce growth in the US isn’t supposed to be robust, but it remains positive. This coupled emerging worker productivity improvements from artificial intelligence should be a powerful combination. India leads the pack, but it carries a rather small weighting in most international equity indices.

We believe the US stock market is structurally advantaged with firms that benefit from major secular trends, already have global scale, and are largely unrivaled. We have our own issues, but in our opinion, these are much less concerning compared to the challenges we see for many companies overseas.

Understanding the difference between “cheap” and “value” can save investors a lot of frustration.

The opinions expressed are those of Harrison Financial Services as of January 25, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested.