There’s a long-lasting saying when it comes to equity investing; “time in the market beats timing the market.” Of course, it’s long-lasting because it’s generally true. However, it keeps getting repeated because not enough people follow such advice. Bear markets are scary, so investing additional dollars during them may seem like a bad idea. Many think they’re better off just waiting it out until things calm down. However, when volatility finally settles, prices are usually at higher levels. Then some wonder whether they missed their opportunity. Instead, they’re left sitting on cash, waiting for that “right” moment, which may never come.

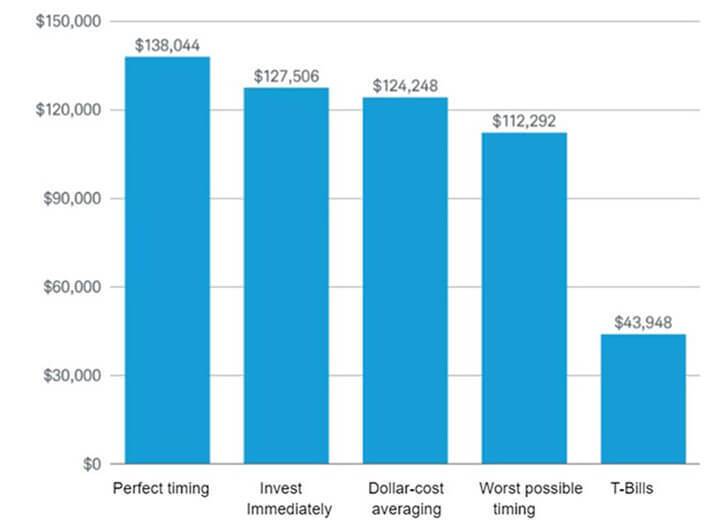

Even the Worst Market Timing Beats Inertia

(2003-2022)

Source: Schwab Center for Financial Research

Each individual invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2003-2022.The individual who never bought stocks invested in a hypothetical portfolio that tracks the lbbotson U.S. 30-day Treasury Bill Index. Dividends and interest are assumed to have been reinvested, and the examples do not reflect the effects of taxes, expenses, or fees. The examples are hypothetical and provided for illustrative purposes only. All investments carry some level of risk, including the potential loss of principal invested. No investing strategy can assure a profit or protect against loss. You cannot invest directly in an index.

A recent study by Charles Schwab evaluated how five hypothetical people with different styles invested their money. Each received $2,000 at the start of the year for 20 years to invest in the S&P 500. These hypothetical portfolios were based on actual performance of this benchmark through 2022, and assumed a buy-and-hold strategy once invested. Unsurprisingly, the one with perfect timing that invested their $2,000 into the market every year at the lowest closing point did the best. However, this skill obviously does not exist. A close second was immediately investing the $2,000 on the first trading day of every year, which lagged “perfection” by only $10,537. Next was dollar-cost averaging where the individual invested in equal tranches at the start of each month. The one with the worst timing, or investing at the year’s market highs, placed fourth. A distant last was someone who just couldn’t get off the sidelines and stuck with Treasury bills, waiting for a better opportunity that never came.

While this study took place from 2002 to 2022, Schwab looked at 78 different 20-year periods dating back to 1926 and found similar results across all periods. Investing immediately never came in last. In fact, it beat dollar-cost averaging in every 30, 40, and 50-year period. With that being said, dollar-cost averaging can be a good strategy if you’re prone to regret your decision after a short-term drop. Nothing did worse than staying in cash – even against the worst market timers.

Peter Lynch famously said, “Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” Now that the most recent bear market is over, we believe many investors can relate.

The good news is that it’s not too late.

The opinions expressed are those of Harrison Financial Services as of January 31, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security.