Everybody loves a prediction. Whether it’s a sporting event, an election, the weather, or the stock market, the “experts” will give their rationale and attempt to forecast the future. With 2024 upon us, it’s that time of year for stock market outlooks. While these predictions are a fun thing to talk about, they shouldn’t influence your investment strategy. Not only are they typically wrong, but they’re usually based upon overly simplistic assumptions. Each strategist has their biases, whether bullish, bearish, value, or growth, and few want to take the risk of being the outlier.

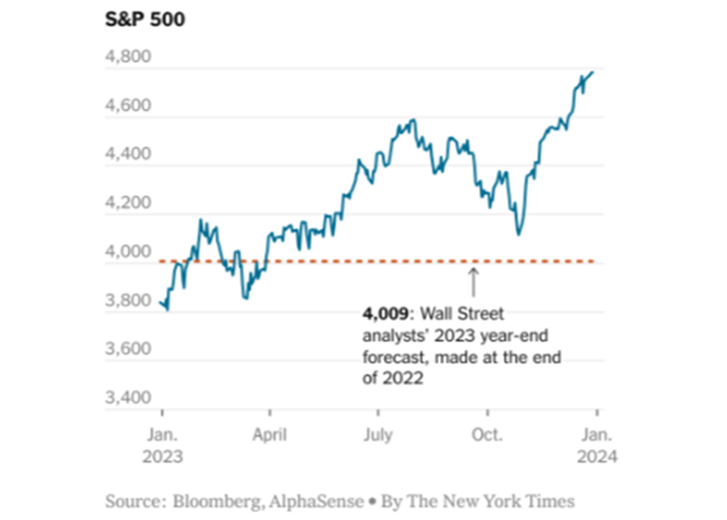

To prove our point about the inaccuracy of market predictions, we need only to rewind to this time last year. At that time, the question wasn’t “if” we were going to have a recession, it was how severe it would be. The S&P 500 closed at 3839.50 at the end of 2022, and the consensus Wall Street forecast called for a mere 4% gain with a weak first half and a rebound in the 2H23. The “experts” forgot to add a “20” to their forecast as the S&P 500 closed 2023 at 4769.83 for a gain of 24% (excluding dividends).

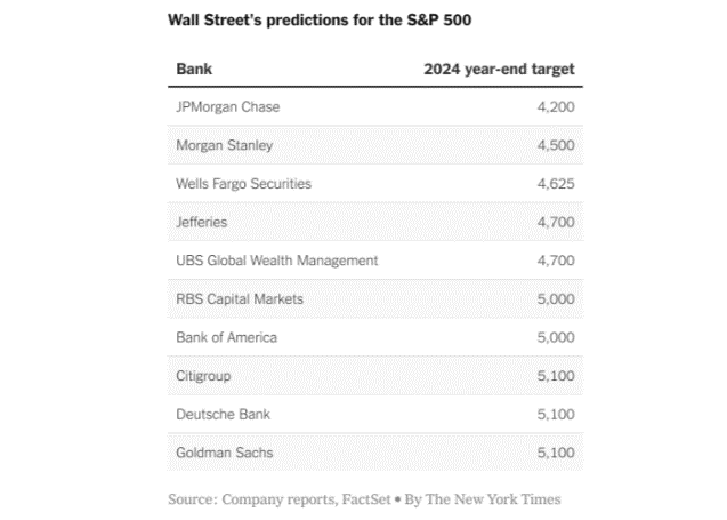

Additionally, these predictions are far from scientific. From our experience, most strategists look at the consensus earnings estimate for the S&P 500 in the coming year. Some might take this number up or down a bit based upon their particular macro view. Next, they apply an “appropriate” Price/Earnings (P/E) multiple to this number. However, this is largely based upon rather narrow historical ranges that gets nudged a little in either direction depending on growth rates, interest rates, monetary/fiscal policy, etc. The next step is to round to the nearest whole number, and there’s your year-end target for the S&P 500. Odds are that it will be revised several times over the course of the year.

Don’t get us wrong. There are some very intelligent people behind these predictions. Our point is that investing is hard, and it becomes even more difficult when asked to predict a precise outcome that’s only a year away. Not even Warren Buffett gives year-end market targets. When asked, he just reiterates that stocks generally rise. He’s right. Since 1926, US stocks have posted calendar year gains 73% of the time1.

Take market predictions for what they are –entertainment that can be thought provoking. Most money managers at these investment banks don’t follow their strategist’s advice. Nor should you.

The opinions expressed are those of Harrison Financial Services as of January 4, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

1 – 2023 Morningstar Direct. Stocks are represented by the Ibbotson US Large Company Stock Total Return Index from 1926 – 1936 and the S&P 500 Total Return Index from 1937 to present.