“Did I miss it?” It’s a natural question for investors to ask. It’s easy to look at rising stock prices and think that the opportunity has passed you by. Maybe some even go so far as to label it a “bubble” as some form of justification. However, it’s harder to think about and understand why that price appreciation occurred, and more importantly, if it will continue. That’s why HFS spent so much time talking about artificial intelligence (AI) during our most recent 2024 outlook. While others are obsessively focused on the Fed, inflation, and the upcoming elections, HFS is concentrated on powerful implications of AI, which we feel is more important. We have a unique perspective too, having spent 25 years studying and following the semiconductor industry, ranging from analog chips, processors, memory, manufacturing, materials, chip design software, etc. This industry is the engine of AI, which some believe can be bigger than the personal computer, mobile computing, and even the internet itself. Count us in that group. Once you have a better perspective of what’s happening, HFS believes that clients will come to a similar conclusion – this is just the beginning.

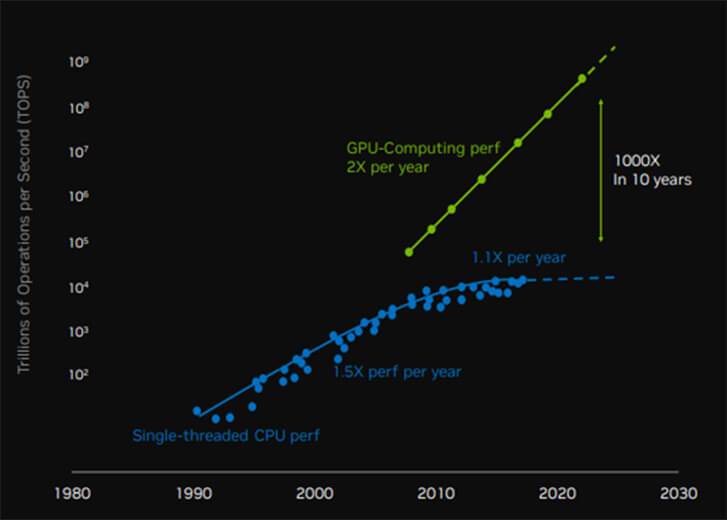

The Emergence of Accelerated Computing

Source: Nvidia

Earlier this week, the world’s largest provider of AI chips reported quarterly earnings and delivered impressive results against elevated expectations. Specifically, this company provides GPUs (graphics processing units), which traditionally were used mostly for video games. These are very different than the semiconductor chips found in traditional computers and servers, which are called CPUs (central processing units). A key distinction is that GPUs enable “parallel processing” as opposed to “sequential”.

A good analogy is thinking of a line at a concession stand. A CPU is similar to one person working at the checkout register – customers must line up single file and wait for the person in front of them to be served. A GPU is like multiple checkout lanes opening up so everyone can be served simultaneously without lines.

This ability to do parallel processing is being called “accelerated computing”. While GPUs are a necessity to train and power AI applications, many believe that they will be needed to replace the large base of CPUs that have been installed over the past 40 years. In fact, the CEO of the world’s largest GPU provider believes this market opportunity alone measures around $1 trillion for data centers alone.

HFS believes we’re on the verge of seeing all devices become “AI powered”. This includes AI mobile phones, personal computers, televisions, surgical devices, and even cars.

In short, we believe that we’re much closer to the beginning as opposed to the end.

The opinions expressed are those of Harrison Financial Services as of February 22, 2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.